It may turn out to be negative if the variable cost is more that the revenue can cover. Contribution format income statements can be drawn up with data from more than one year’s income statements, when a person is interested in tracking contribution margins over time. Perhaps even more usefully, they can be drawn up for each product line or service.

Contribution Margin Ratio:

This means that, for every dollar of sales, after the costs that were directly related to the sales were subtracted, 34 cents remained to contribute toward paying for the indirect (fixed) costs and later for profit. Very low or negative contribution margin values indicate economically nonviable products whose manufacturing and sales eat up a large portion of the revenues. Investors examine contribution margins to determine if a company is using its revenue effectively. A high contribution margin indicates that a company tends to bring in more money than it spends. Alternatively, the company can also try finding ways to improve revenues. However, this strategy could ultimately backfire, and hurt profits if customers are unwilling to pay the higher price.

Contribution Margin Per Unit:

The contribution margin tells us whether the unit, product line, department, or company is contributing to covering fixed costs. The contribution margin ratio represents a company’s revenue minus variable costs, divided by its revenue. In short, it is the proportion of revenue left over after paying for variable costs. Decisions can be taken regarding new product launch or to discontinue the production and sale of goods that are no longer profitable or has lost its importance in the market.

How confident are you in your long term financial plan?

Once you calculate your contribution margin, you can determine whether one product or another is ultimately better for your bottom line. Still, of course, this is just one of the critical financial metrics you need to master as a business owner. They can use that information to determine whether the company prices its products accurately or is likely to turn a profit without looking at that company’s balance sheet or other financial information. A low margin typically means that the company, product line, or department isn’t that profitable. An increase like this will have rippling effects as production increases. Management must be careful and analyze why CM is low before making any decisions about closing an unprofitable department or discontinuing a product, as things could change in the near future.

- Building a cash flow statement from scratch using a company income statement and balance sheet is one of the most fundamental finance exercises commonly used to test interns and full-time professionals at elite level finance firms.

- This metric is typically used to calculate the break even point of a production process and set the pricing of a product.

- However, they will play an important part in calculating the net income formula.

- For this section of the exercise, the key takeaway is that the CM requires matching the revenue from the sale of a specific product line, along with coinciding variable costs for that particular product.

For example, raising prices increases contribution margin in the short term, but it could also lead to lower sales volume in the long run if buyers are unhappy about it. Before making any changes to your pricing or production processes, weigh the potential costs and benefits. In the same example, CMR per unit is $100-$40/$100, which is equal to 0.60 or 60%. So, 60% of your revenue is available to cover your fixed costs and contribute to profit.

Along with the company management, vigilant investors may keep a close eye on the contribution margin of a high-performing product relative to other products in order to assess the company’s dependence on its star performer. Another common example of a fixed cost is the rent paid liability: definition types example and assets vs liabilities for a business space. A store owner will pay a fixed monthly cost for the store space regardless of how many goods are sold. Here, we are calculating the contribution margin on a per-unit basis, but the same values would be obtained if we had used the total figures instead.

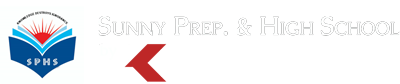

Fixed costs remained unchanged; however, as more units are produced and sold, more of the per-unit sales price is available to contribute to the company’s net income. Direct materials are often typical variable costs, because you normally use more direct materials when you produce more items. In our example, if the students sold \(100\) shirts, assuming an individual variable cost per shirt of \(\$10\), the total variable costs would be \(\$1,000\) (\(100 × \$10\)). If they sold \(250\) shirts, again assuming an individual variable cost per shirt of \(\$10\), then the total variable costs would \(\$2,500 (250 × \$10)\). It means there’s more money for covering fixed costs and contributing to profit.

This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. For instance, in Year 0, we use the following formula to arrive at a contribution margin of $60.00 per unit. If the contribution margin is too low, the current price point may need to be reconsidered.