This discount is common for conglomerates, as the market often values them below the sum petty cash of their parts. However, it also presents an opportunity for investors to earn capital gains, as POW’s management is actively working to narrow this gap. High interest rates have also diminished the value of bonds that banks typically hold on their balance sheet. When calculating dividend yield, it’s important to understand that the rate can change. For example, a company might fall on hard times and lower their dividend.

Return of Capital Distributions

Its common stock has a par value of $1 per share and a market price of $5 per share. A what type of account is dividends company with a long history of dividend payments that declares a reduction or elimination of its dividend signals trouble. AT&T Inc. cut its annual dividend in half to $1.11 on Feb. 1, 2022, and its shares fell 4% that day.

Nutrien earnings

Chartered https://www.facebook.com/BooksTimeInc accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping. He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries. He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University.

Do Dividends Go on an Income Statement?

Dividends are commonly distributed to shareholders quarterly, though some companies may pay dividends semi-annually. Payments can be received as cash or as reinvestment into shares of company stock. A capital dividend can only be declared if the CDA balance is positive.

- Many companies pride themselves on paying dividends regardless of market conditions or other factors.

- They do not impact the income statement because the value of retained earnings on the income statement is reported after the dividends have been paid out.

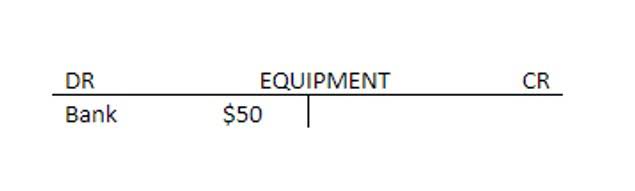

- The company makes journal entry on this date to eliminate the dividend payable and reduce the cash in the amount of dividends declared.

- Double Entry Bookkeeping is here to provide you with free online information to help you learn and understand bookkeeping and introductory accounting.

- The share price is up about 29% in the past year, but still sits well below the $93 it reached in early 2022.

- Additionally, companies must provide detailed disclosures about their dividend policies, the amount of dividends declared and paid, and any restrictions on the payment of dividends.

Large Stock Dividend Accounting

When paid, the stock dividend amount reduces retained earnings and increases the common stock account. Stock dividends do not change the asset side of the balance sheet—they merely reallocate retained earnings to common stock. With this journal entry, the statement of retained earnings for the 2019 accounting period will show a $250,000 reduction to retained earnings.